In today’s uncertain economic climate, the need for personal loans has increased significantly, even for individuals with less-than-ideal credit scores. Fortunately, the online lending industry has evolved to meet this demand. However, obtaining a personal loan with bad credit can be a challenging task. It requires a comprehensive understanding of the lending process and the various options available to you. In this article, we’ll provide you with a detailed overview of how to navigate the process of obtaining a personal loan online with bad credit.

But first, it’s important to understand what “bad credit” means

Understanding Bad Credit

Your credit score, ranging from 300 to 850, is a numerical representation of your creditworthiness derived from your credit history. A score below 580 is generally classified as ‘bad credit’ by most lenders. Even though having bad credit can be a hurdle, it’s not an insurmountable one.

Step 1: Assess Your Credit Report and Score

Before you begin the loan application process, obtain a copy of your credit report from major credit bureaus. Scrutinize it for errors or discrepancies, as these can further deteriorate your credit score. If you find any inaccuracies, take immediate steps to rectify them.

Step 2: Explore Your Options

1. Online Lenders: Many online lenders have tailored their services to cater to individuals with bad credit. These lenders often consider other factors like your employment history and educational background. You can also visit Credmudra, which finds the right lender for you in minutes based on your requirements. Furthermore, it advocates for people having bad credit scores.

2. Peer-to-peer (P2P) Lending Platforms: P2P platforms connect borrowers with individual investors. Though these platforms conduct credit checks, their lending criteria may be more flexible than traditional banks.

3. Credit Unions: Being member-oriented, credit unions often offer loans with more favorable terms and lower interest rates compared to traditional banks, even for members with bad credit.

Step 3: Analyze the Terms Carefully

While the prospect of obtaining a loan with bad credit is relieving, it’s essential to meticulously assess the terms. Look out for:

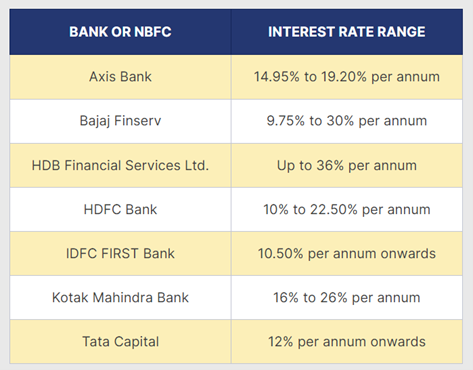

- Interest Rates: Loans for bad credit often come with higher interest rates. Compare rates from different lenders to ensure you’re getting the best deal. Below are the rates of interest offered by the banks or NBFC; you can check them out on Credmudra:

- Fees and Penalties: Understand the origination fees, prepayment penalties, and late payment fees that might be associated with the loan.

- Repayment Terms: Scrutinize the loan’s repayment period and ensure the monthly payment is within your budget.

Step 4: Apply with a Co-signer or Opt for a Secured Loan

If possible, apply for the loan with a co-signer who has good credit. Their credit score can bolster your application, potentially securing you a lower interest rate. Alternatively, consider a secured loan where you put up collateral. This can increase the lender’s trust, possibly leading to better loan terms.

Step 5: Prequalify and Apply

Prequalify with multiple lenders to gauge the potential loan terms without impacting your credit score. Once you’ve found the most favorable terms, complete the application process. Ensure you have all necessary documents, such as proof of income and identification, at hand.

Step 6: Plan Your Repayment Strategy

Upon securing the loan, it’s crucial to plan for timely repayments. Consistent, punctual payments can gradually improve your credit score, opening doors to better financial opportunities in the future. It’s also a good idea to have a plan for paying back the loan on time every month. This can help improve your credit score over time, which will make things easier for you in the future.

Obtaining a personal loan online with bad credit is a feasible option, provided you take a thoughtful and informed approach. By understanding your credit, exploring various lending options, and meticulously analyzing the terms and conditions, you can navigate this path with confidence. Remember, the journey towards financial stability is a marathon, not a sprint. Every decision and every payment impacts your credit score and, ultimately, your financial future.

Overall, getting a loan with bad credit is possible as long as you do your research and find a lender who is willing to work with you. Good luck!

Be First to Comment